Alert: Unusually Strong Volume

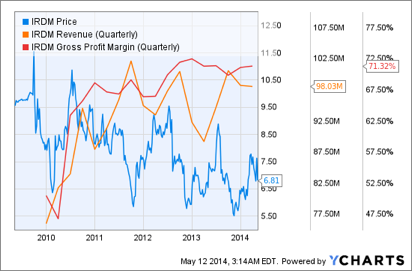

Iridium Communications (IRDM) – $6.81

Friday’s investor stampede into IRDM was triggered by a successful capital raise of $170M (gross), suggesting the company’s short-term and intermediate outlook remain sound. With $184M cash on the books ($3.32 Total Cash per Share), a Current Ratio of 3.38, the company’s liquidity is superior. A quarterly revenue grow of 6.4%, Gross Profit Margin of 71.3%, and an Operating Margin of 28.9%, IRDM’s demonstrates the pricing power of its business model. Debt levels to equity is inline with, or better than, the telecommunications services industry’s average. IRDM’s profit margin of 15.8% is better than the industry average. And a revenue growth rate of 6.4% is more than double the average growth rate of its peers. For the first time since late April, IRDM closed above its 200-day EMA on Friday.

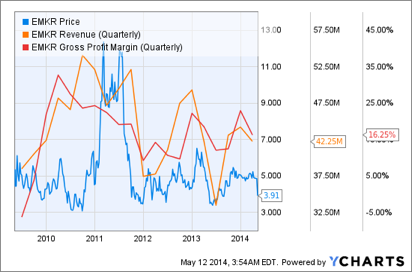

EMCORE (EMKR) – $3.91

Alert: Unusually Strong Volume

Earnings popped shares of EMKR 7.4% off the lows on Friday. More than three-time the average daily volume supported the share price of EMKR, following a second successful test of the $3.75 support. A disappointing earnings report on Wednesday slammed the stock below its 200-day EMA. In the Q2 report, Gross Margins decreased in both the company’s Fiber Optics and Photovoltaic business, continuing to plague EMKR more acutely when compared to the industry average. Net Loss widened to $(5.23M) in Q2, from $(2.4M) for Q2 last year. However, EMKR’s 22% drop in share price since May 7 may have been overdone. The company’s share price now trades at a Price/Book of 1.24 and a Price/Sales of 0.74, with the latter indicating a 65% discount to the industry’s 2.11 Price/Sales average. At the company’s current rate of intermittent negative cash flow, the $18.2M of cash on the books appears to be sufficient for at least one year of cash burn. EMKR could provide some volatility in coming days as the stock seeks to find bids against a 34.8% short position of the company’s float. Together, Insiders and Institutions hold approximately 51% of the stock.

Liquid Holdings Group (LIQD) – $2.95

Alert: Unusually Strong Volume

At only $73.4M of market capitalization, LIQD is among the smallest telecom services businesses in the industry. Discussions by traders following Friday’s trade indicate that in late-morning trading LIQD had little to NO liquidity! Though there has been no news since the Q1 report of Apr. 29, controversy stemming from the company’s Apr. 2 SEC form S-8, which granted permission for the sale of 1,668,888 shares held by employees and others affiliated with LIQD, has since spooked investors. We alert traders to the stock due the heavy volume that rushed in as the stock approached $2 per share on Friday. While LIQD has dropped approximately 50% from the close of trading on Apr. 30, a new trading range appears to be developing from the bottom range of $2. Adding to the pressure on the stock is LIQD’s cash position. With only $8.4M of cash in the bank and an annual cash burn rate that exceeds that amount, the company will most likely need to raise cash. High volatility is expected until a new level for the stock between the $2 and $4 range plays out. A Short % of float of only 3.1% (source: Yahoo finance) suggests that the bulls will not be able to rely on the possibility of any short squeezes. Instead, fresh buying needs to be initiated.

iPass (IPAS) – $1.18

Alert: Unusually Strong Volume

On Friday, IPAS rebounded from Thursday’s disappointing Q1 earnings report. After plunging 35.2% following the report, IPAS has drawn strong bids at the $1.1 price level. Revenue for Q1 dropped to $25.3M, from $29.6M for the same period one year ago. The company cited bad weather in Europe for the drop in revenue. However, CEO Even Kaplan stated in the conference call, “March and April have both shown better than expected strength.” IPAS trades at a Price/Sales of 0.69 against an industry average of 0.81. But the condition for a strong rebound could come from a very large and recent short position in the stock taken on May 8 and 9. Any significant bargain hunting could scare the shorts out of their positions in the coming days. Already a recipient of 43% of IPAS’s float, institutions seeking more shares at much lower price levels could provide support for the stock above $1 per share. The company holds $20.1M of cash, more than enough to handle recent cash burns of less than $1M per fiscal quarter. At $0.30 of cash per share, IPAS represents a rather steep discount, which may suggest a strong negative sentiment for the company’s outlook. If the company can at least level-off revenues in coming quarters, from more than four full years of declines, additional institution money will most likely enter. For the short term, risks of a short squeeze remain high this week.

Intellicheck Mobilisa (IDN) $0.769

Alert: Unusually Strong Volume

Since 2009, IDN’s revenue and stock price have sloped downward, but that reversal in fortunes for investors may be changing. Following an announcement from the company of its new App, called Fugitive Finder, law enforcement will be able to perform faster and more convenient checks with the FBI’s National Crime Information Center (NCIC). At $49 per month fee ($588 annual), per officer, and a market size of 875,000 U.S. law enforcement officers with arrest powers working in the U.S., IDN’s potential to meaningfully grow its top line with Fugitive Finder drove many new investors into IDN on Friday. IDN’s successful capital raise earlier this month of a gross take-down of a little more than $2M provides a cushion against a three-year $421K average annual cash flow shortfall. If IDN’s 62% Gross Margin in fiscal 2013 remains within range during fiscal 2014-15, the company will most likely generate healthy Net Profits from its marketing efforts to promote Fugitive Finder. IDN’s Price/Book is 1.05. The Price/Sales is 2.93 against an industry average of 3.33. Insiders hold a whopping 43.7% of IDN’s float.

0 Comments