New month and a goal of +$20,000 realized profit swing trading 3 – 5 times a week.

2014 performance is +36% +$65,480 compared to the S&P 500 +1.93%.

2013 performance was +77.18% +$238,830 compared to the S&P 500 +29.60%.

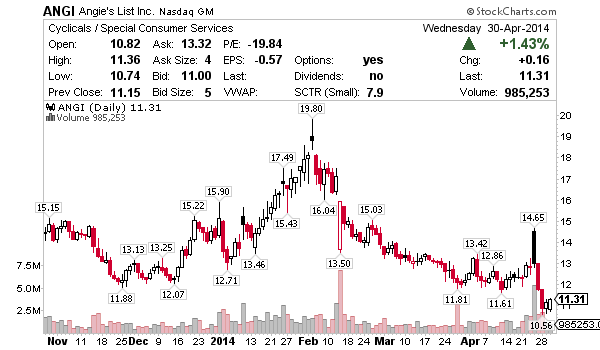

Picked up some ANGI Wednesday and thinking I’ll add to my position Thursday for a move to the $12’s, here’s the portfolio.

Focus group tonight at 8 p.m. EST in chat.

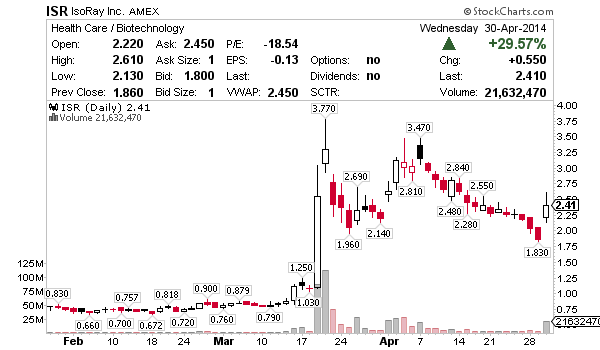

Big win on ISR in the chat room Wednesday, join us for more action.

Good start for CETV, END from Wednesday’s watch list. I like both those and they’re still in play. MVIS finished down on the day but didn’t break pattern so it’s still in play too.

Here’s my game plan Thursday. To get my entry and exit alerts, video lessons and access to the stock chat join Jason Bond Picks.

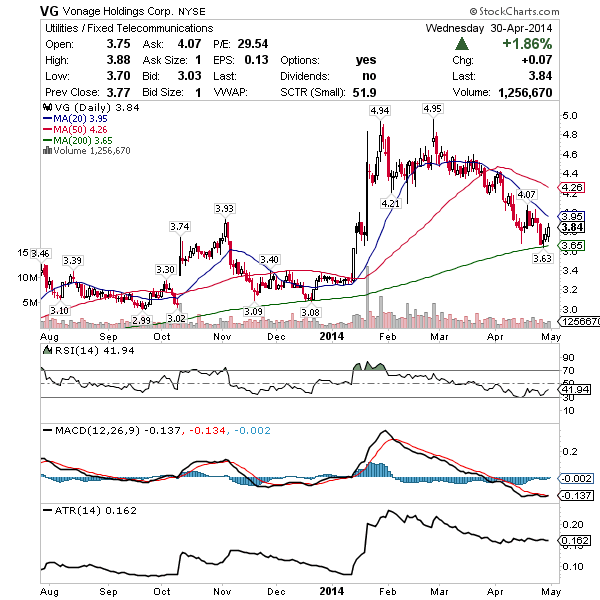

VG – Coming off the 200 Moving Average with buyback activity I’m watching for entry above $3.70. This has a lower ATR of $.16 so I’ll be positioning big if I take this trade, maybe 20,000 shares looking for $.10 – $.20 / share.

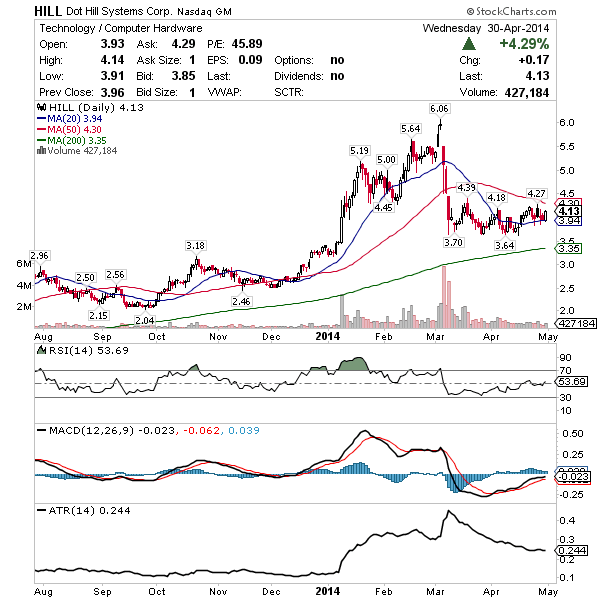

HILL – Consolidation continues above the 20 Moving Average, if shares rise above the 50 Moving Average momentum favors the bulls. There’s good support around $4 which is where I’m watching for entry.

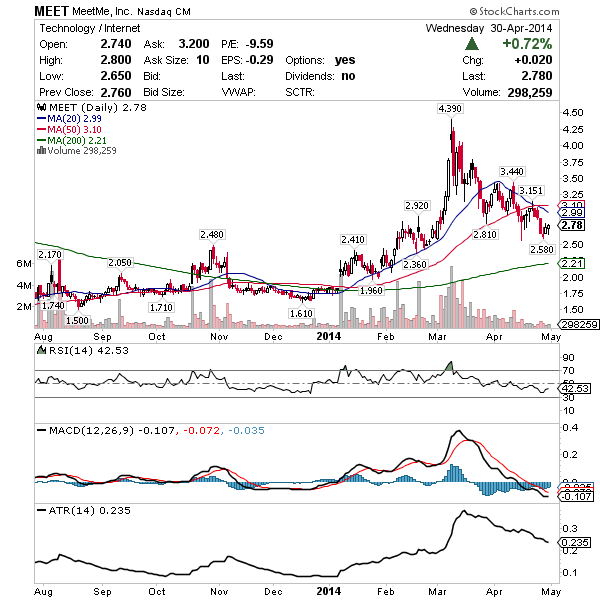

MEET – With Facebook advancing, MeetMe looks poised to reverse ahead of their next earnings call. I like this above $2.70 support and there’s range to the low $3’s making this one of my favorite on the list today.

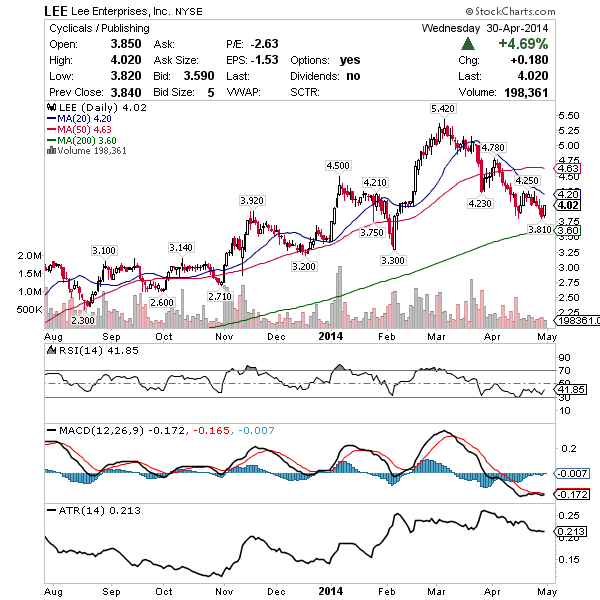

LEE – Symmetrical triangle formed with support off the bottom trendline. Entry above $3.90 with juicy range to the upper $4’s making this my favorite pick on the list today.

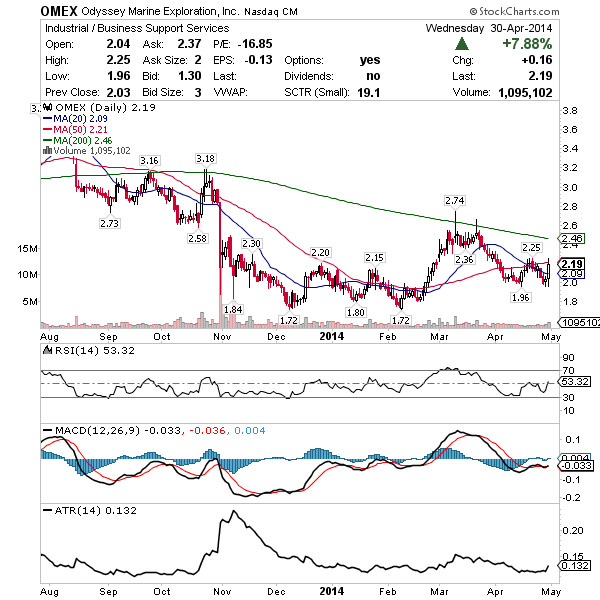

OMEX – This is my short squeeze play into the weekend. Wednesday’s price action and volume suggests shorts are getting impatient since $2 didn’t break support recently. Entry above $2 with range to $2.60’s is what I’m thinking. Days to cover is 32 with 27% of the float short.

I have tried penny stocks t he only thing about it is you keep it for a while and it does not move and you sell itback to the broker they charge you $25.00 TO CLOSE IT OUT so you lose no matter what is there any other way out

Different brokers have different policies regarding penny stocks. You may want to switch to TD Ameritrade which has a flat rate of $9.99/trade in and $9.99/trade out. Scottrade also has flat rates: $7/trade in & $7/trade out. Fidelity too: $6.95/trade in and $6.95/trade out. If you have enough capital, you should look into Merrill Edge where you may qualify for no commission trades.

Sharebuilder is $4 trade-in and $6.95 trade-out.