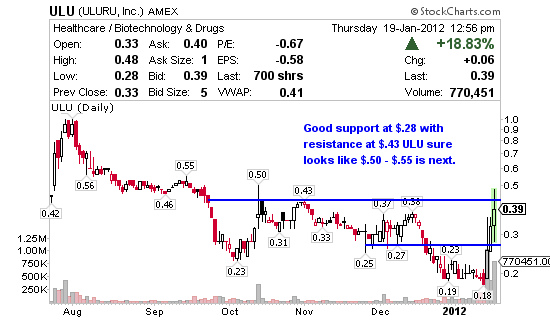

Uluru (AMEX:ULU) a pharmaceutical company, engages in the research, development, and commercialization of wound care and muco-adhesive film products in the United States and internationally. ULU is up 117% in 3 days and showing very few signs of slowing. The Relative Strength reading of 70.08 is quite top heavy but so long as volume continues to grow it can hold these levels. Support can clearly be seen at $.29 or the 50 Moving Average with resistance at $.43 and $.50 ahead.

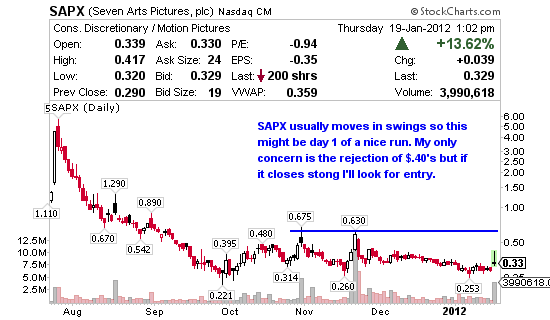

Seven Arts Pictures (NASDAQ:SAPX) operates as an independent motion picture production and distribution company. It engages in the development, acquisition, financing, production, and licensing of theatrical motion pictures for exhibition in theatrical markets worldwide. Nice move on SAPX today and we’ve traded this one successfully before. It usually runs in 3 day patterns so there’s a good chance this one moves up into Friday. (See my last SAPX trade) So into the close I’d like to see it above $.35 for me to consider a swing with an upside goal of $.42 – $.45 first goal and $.60 second goal.

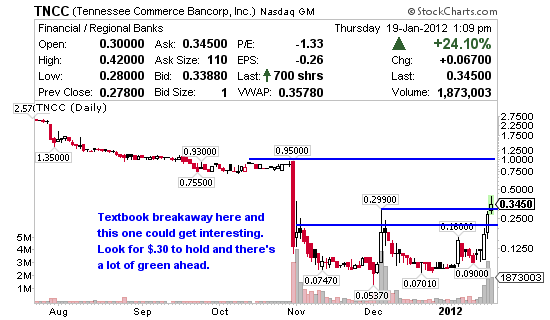

Tennessee Commerce Bancorp (NASDAQ:TNCC) operates as the bank holding company for Tennessee Commerce Bank that offers various retail and commercial banking services to small to medium-sized businesses, entrepreneurs, and professionals in the Nashville metropolitan statistical area, Tennessee. Hard to argue this chart, had I been scanning under $.50 Tuesday this would have been a solid alert. Either way I’m thinking it’s not done although the Relative Strength is high at 77.36. Hold $.30 and consolidate and the upside could be great here.

Daystar Technologies (NASDAQ:DSTI) is a development stage company, engages in the development, manufacture, and marketing of solar photovoltaic products to the grid-tied and ground-based photovoltaic markets. Right at the 200 Moving Average resistance at overbought above the 70 Relative Strength it would appear DSTI needs to consolidate before making it’s next breakout move. Looks like a good range would be $.35 to $.50 swing and gamble for the break of $.50 which could lead to $.58.

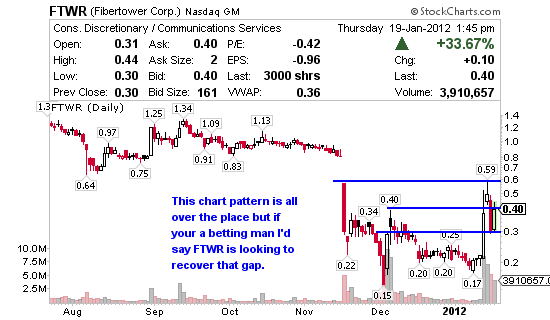

Fibertower (NASDAQ:FTWR) provides facilities-based backhaul services to wireless carriers in the United States. I like FTWR off $.30 although I’m not sure we’ll see it again. So instead a possible gamble at $.40 or $.35 with upside to $.50 – $.60 and honestly, to me I think FTWR is going to recover the gap down around $.75. Stop on a break of $.35 seems to make sense.

Thanks so much, Jason for sharing. I really think you know what you are doing and are very qualified. I am a senior citizen and maybe one day will be a subscriber. It is very kind of you to share some things with your non-subscribers. It is very helpful to hear from someone who you feel is very knowledgable.

Hi Diane. Many thanks to you for saying so. Keep in touch. Jason

Jason,

You picks are great.

But for get gain safe, it is best to get in before it starts rally or at lately, only one day after its rally. Otherwise getting late is very dangouers and lose money.

Thanks Michael. Stocks go up and they go down and in the world of stocks under $10 timing is everything and yes, this is a game precision. The patterns I teach work, oversold, continuation and breakout work but they are short lived. This isn’t long term trading, we’re just looking for $.50 / share and sometimes only $.25 per share.

Hi Jason I am watching your picks and soon I will join your team your picks are great keep the good work as what goes around comes around you help us make money and It will come back to you as you will make double, cheers

Cheers, look forward to you joining.