It’s Friday, the market is looking strong and these small caps are looking juicy because all of them held their ground against Thursday’s bear raid i.e. up on a down day. Today I’m watching for decent entries with an upside goal of 5-10% across the next 1-4 days, rinse and repeat let the money roll over.

Pulse Electronics Corp. (NYSE:PULS) produces precision-engineered electronic components and modules. PULS stock market cap is $79 million with a 52 week range of $1.76 – $4.71 and a Beta of 2.13. The short interest here is 20 days to cover with 10% of the float short. Wednesday’s dollar volume was $701,321 so there’s plenty of liquidity for a swing. Their cash position is $21.15 million with $104.95 million in total debt.

Technically PULS is just off a multiple bottom around $1.77 trading just above the 20 Moving Average. I believe it’ll test $2.10, chop out and push higher to $2.40 before it’s overbought leaving an excellent swing range between the current price of $1.91 and resistance or 10% to the chop and 26% to the desired target. For this to be in play I’d like to see it open and hold the 20 Moving Average Friday.

Rite Aid Corp. (NYSE:RAD) operates retail drugstores in the United States. RAD stock market cap is a lot larger than the others on this list at $1.2 billion so don’t expect it to move fast. Having said that it sure looks like a 5-10% move is reasonable, more on that later. The 52 week range here is $.85 – $2.12 and the Beta is 1.46. The short interest here is 8 days to cover with 8% of the float short. With volume well over $4 million Thursday, clearly RAD’s plenty liquid for pretty much anyone.

Technically RAD is right at the 200 Moving Average and a key technical resistance from the last few months. If the market heads higher Friday I’m looking for it to test $1.39, chop and then head to the $1.50’s across the next few days. We’ve seen RAD put in some big candles in the past and I’m thinking another could be right around the corner if it breaks out of this continuation pattern.

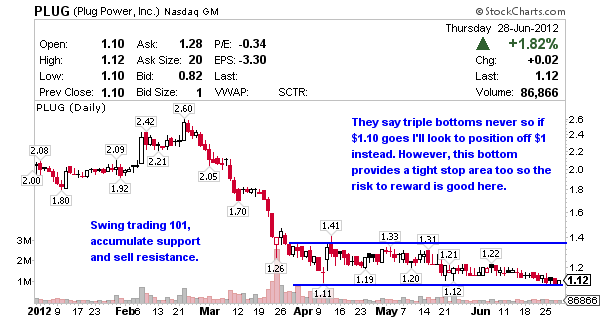

Plug Power (NASDAQ:PLUG) an alternative energy technology provider, engages in the design, development, commercialization, and manufacture of fuel cell systems for the industrial off-road markets worldwide. PLUG stock market cap fits the nano category at $42 million with a 52 week range of $1.10 to $2.71 at a Beta of 1.58. This is a light volume accumulation play down here to swing into the next round of positive news. The short interest is 30 days to cover but that’s misleading since the volume is light and there’s 9% of the float short. What I like about this play is they have $0 debt but as you can see by the chart, that doesn’t matter much in swing trading.

Technically we’re at a triple bottom around $1.10 and the volume is light so it’s an accumulation swing long play. Probably add some size across several buys to scale in and swing the next move up to the $1.30 range which it seems to hit quite regularly, take half off and depending on the market / news coming out of the company let some ride back to the $1.50’s. In my experience triple bottoms never are so be sure support around $1.10 doesn’t let go. If $1.10 does give out, I like it at $1.

do you put an 10% stop loss on all stocks when buying? ..Thank you

No, if I took 10% losses I’d crush my portfolio since I’m putting $50,000 into trades. My goal is 10% profit and a few % loss. Generally I’m trying to get out just a few % off my entry if I pick the wrong direction. From time to time I will let a stock drop 10% if I make an error but think it’ll channel back up for me.

So Jason, if you don’t start out with a 10% stop, what percent do you set your stop below when you 1st buy a stock ?

I’m not setting stops anymore… I don’t like showing my hand I do it manually.

Who and how see’s your hand ? Can somebody actually see your stop’s ? Your kidding me ?

The markets aren’t made for retail.

interestingly enough both PULS and PLUG both made 5% within a day which is my goal RAD is still in play, give it another day or two and I’ll sell it

Since I’m new to trading (not to investing) I’m only paper trading at this point. But so far I like what I see

couple weeks ago you had APGS at 11cents as your buy stock. Now it is at 2 cents. I have lost 80% of my money. How did this come on your radar. I had sent an email earlier but got noreply. Is there any hope this APGS can come back to even 8cents. Please reply what is your suggestion.

vinod

You have me confused with someone else, that was never alerted here at JBP and definitely not as a buy?