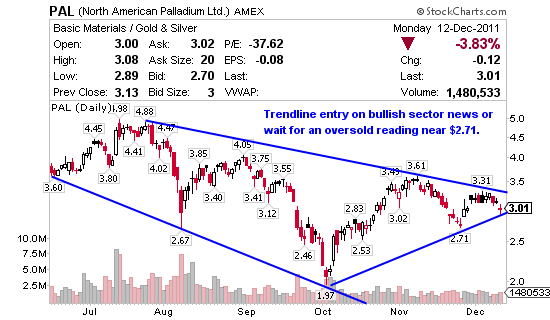

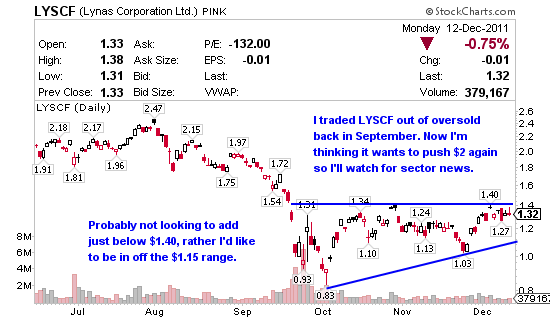

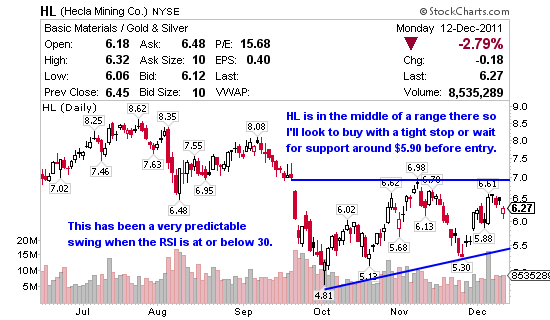

Metals are one of my favorite sectors with PAL, LYSCF and HL being some of my favorite stocks to swing in that sector due to their predictable charts and high Betas all above 2.

A dramatic downturn in demand for the metals has caused prices to slide and rare earth prices have fallen dramatically in recent months. Right now the following stocks are all trading with a Relative Strength around 50, I might try them off the centerline if we get any bullish sector news but if they slip to oversold I’m definitely a buyer.

North American Palladium Ltd. (AMEX:PAL) engages in the exploration and production of palladium and gold properties primarily in Canada. Their balance sheet shows $36.89 million in cash, $2.02 million in debt and a book value of $1.97 per share with 162.85 million shares outstanding. The market cap is a little bigger than my desired $100 – $300 million range at $490.18 million but I’ve traded PAL successfully before and it’s one of my favorite metals to swing, primarily due to its Beta of 2.19. The short interest here is 5.49 days to cover and has been on the rise since summer.

Lynas Corporation Ltd. (PINK:LYSCF) engages in the exploration, procurement, processing, and supply of rare earths products. Big market cap here at $2.28 billion but that didn’t stop me from grabbing the dip back in September and swinging out for a solid profit 1-day later. Their balance sheet shows $202.77 million in cash, $217.03 million in debt and a book value of $.37 per share with 1.71 billion outstanding.

Hecla Mining Co. (NYSE:HL) engages in the discovery, acquisition, development, production, and marketing of silver, gold, lead, and zinc. This morning HL announced it has acquired the remaining 30% interest in the San Juan Silver project at Creede, one of Colorado’s most prolific silver-producing districts. HL has $413.74 million cash, $7.58 million in debt and a book value of $3.93 per share with 279.62 million outstanding. The short interest is relatively small at 3.96 days to cover but has grown since the summer with falling metal prices. Like the two above, Hecla has a big market cap of $1.75 billion relative to what I normally swing between $100 – $300 million, however, the chart has been predictable in 2011 with strong bounces off the centerline and even more pronounced off an oversold Relative Strength at or below the 30 line. With a Beta of 2.43 you can be in for a quick and profitable ride if you swing HL at the right time.

0 Comments