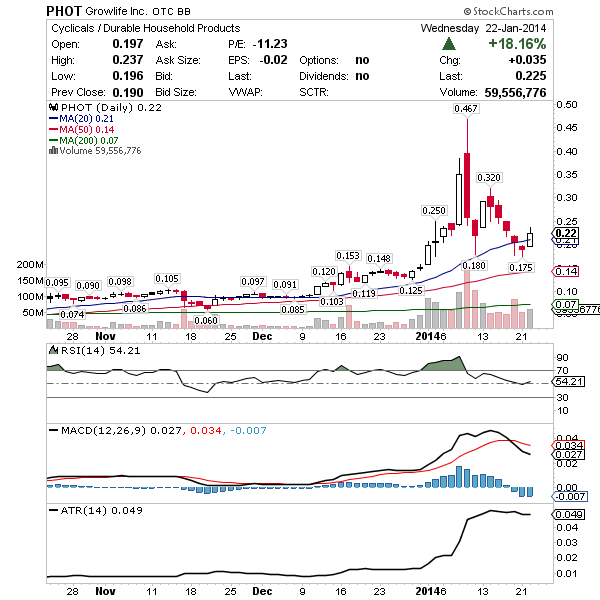

Solid performance Wednesday +10% +$2,130 on PHOT and another good example of this video lesson detailing when a swing trade should become a day trade.

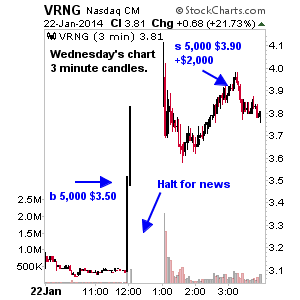

Was also able to get in VRNG just as it started screaming and right before it was halted on news. Good reason to be in the Bond Day Trades stock chat with over 600 users daily, nailed 12% +$2,000 there.

If you don’t have access to the Bond Day Trades stock chat, upgrade to the Jason Bond Picks Bundle. Email jason@jasononbpicks.com and I’ll get you setup. That one trade alone paid for a full year of service on a tiny $17,500 investment across a few hours.

Another reason to upgrade to the Jason Bond Picks Bundle is for webinars covering all aspects of trading in the Bond Day Trades chat room. Webinars start back up next week, the calendar will be out this weekend.

Another reason to upgrade to the Jason Bond Picks Bundle is for webinars covering all aspects of trading in the Bond Day Trades chat room. Webinars start back up next week, the calendar will be out this weekend.

All portfolios +11.9% +$35,707 in the first month of 2014 compared to a red S&P 500.

U.S. stock futures are red this morning as earnings season continues. I’m already short a few positions with Bond Short Selling so for Bond Swing Trades my attention will shift to the marijuana sector because it appears momentum is returning and I wouldn’t expect that to be disrupted by the broader indice weakness.

PHOT – Above $.21 and I’m looking to get back in for a move to $.30. I’d say this is my favorite chart. I am aware of the 1 billion to 3 billion share increase proposal coming in early February, though I don’t think that will impact this trade / timeline we’re discussing.

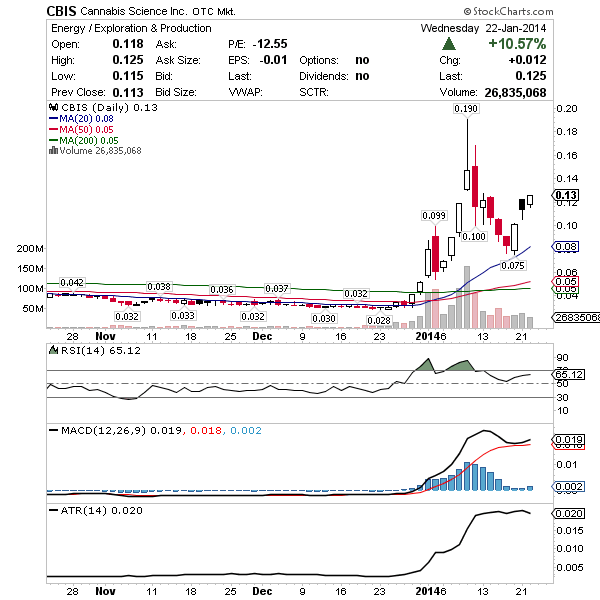

CBIS – If $.12 holds I believe there’s range to $.16 before this slows. It’s already a little more extended than I like up from the $.075 bounce so I’ll trade this one with a tight stop.

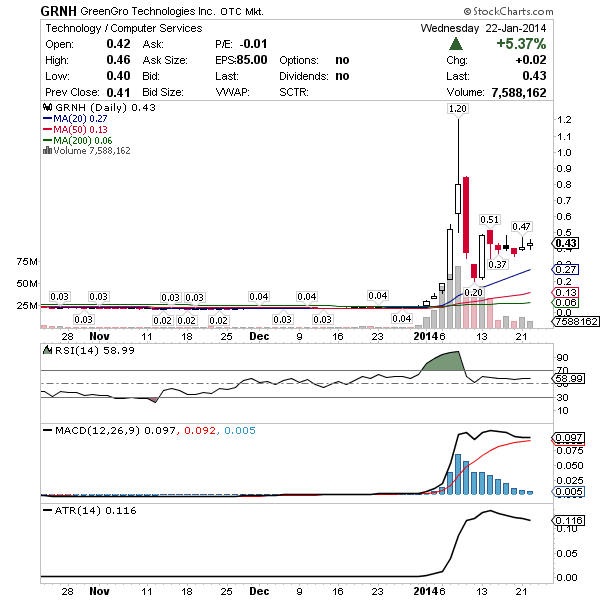

GRNH – Solid continuation pattern loaded with shorts and could squeeze big if $.48 resistance falls which I think is quite possible. It’ll just depend if marijuana stocks can hold a bid and momentum into the weekend. Thursday should be the pivot so we’ll know today I think.

I’m a virgin to investing but with my taxes coming back soon I very, very much want into this exciting new possibility of earning, I need some basic help as to what and how to set up an account for investing. Any and all help would be so welcome! Cheers!

Start by ordering Steve Nison’s The Candlestick Course, $50 green book.

Just a note to David – this is trading NOT investing. Totally different. If you are really young (in your 20’s) I highly suggest investing long term in dividend growth stocks.

Steve Nison’s The Candlestick Course = Best Book on Candles ever. A must book for every serious investor

Lou and Sergey bring up good points. I have Nison’s Japanese Candlesticks 2nd ed. right next to me. Per Lou, I think a balanced portfolio with 15-30% (depending on how young in 20’s and risk aversion) for speculation is great.