Hello, hello!

It isn’t often I put out a free alert but I think I’ve found a winner that could turn another 20% short term, possibly sooner.

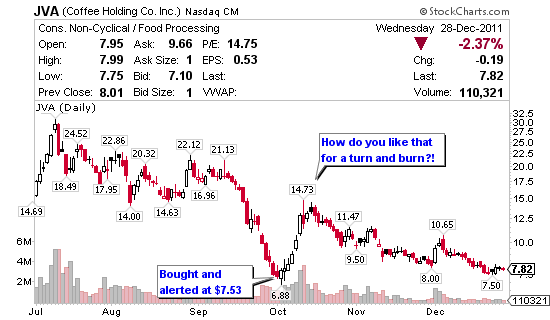

Yesterday I put out JVA to my paid list at $7.53 after buying 1,000 shares which I still own. I have a goal of $.50 to $2.50 per share on it’s way to $10 short term, possibly more but I’m not a greedy trader who usually looks for 10% on trades.

My reasoning is simple and logical.

1. Coffee, the commodity, is down about 28% since its peak in May meaning traders can take advantage of the drop in coffee by looking at coffee retailers.

2. JVA took a hit on the chin after their most recent earnings at which point it’s fallen from roughly $18.50 to it’s low today of $6.90 meaning it’s definitely oversold. The markets have been choppy to say the least recently but JVA is starting to establish support and make the turn. Once a bottom is in, short sellers start to watch much closer. In addition, I think we start to see the markets head up into the end of this week.

3. Technically, JVA is printing a hammer candle rejecting lower levels with support at $7. Now it’s not a perfect hammer in which the lower shadow would be 2/3’s the size of the real body but as of this report it’s pretty darn close. If we close at the HOD today then I suspect it’ll be enough to attract bottom feeders.

4. Most importantly, short interest on this stock is big. I have two brokers and have not been able to get shares at either for quite some time now. This fact means any turn on the chart could cause shorts to start locking in profit and their covering would bode well for early entrants i.e. my $6,200 LOCM win gaming the short squeeze just days before it ran. Now if you don’t know what it means to be short and why they’d be looking to cover soon, then email me at jason@jasonbondpicks.com and we can chat about that.

So here is the trade idea if you’re interested. Mind you, I have 1k JVA at $7.53 and am looking to add 1k more before getting $.50 to $2.00 per share out of this trade short term.

First, JVA must hold $7 to stay in play. Yes there is support below but I’ve learned to keep my losses small and let me winners ride. Today marks the first turn on the chart since it tried to rally around $11. With the MA(200) at $9.98 that’s at least 20% profit from here. If you keep a tight stop of $7.38 or today’s support you’re looking at excellent risk to reward.

Keep in mind, JVA is a tiny market cap of $42 million so buying market isn’t always wise, better to use limit orders on a stock like this, unless it’s flying that is.

Good luck, hope to see you in chat soon.

The Teacher!!!

Jason Bond

I receive your email every daily I think you are very experience teacher I read your every singal email thank you

Thanks Jatinder! Happy Holidays.