Today’s market was a mess to say the least so when you go shopping for swing trades into Tuesday, one strategy I teach is to scan for stocks that bucked the trend and were up on a down day. I like something that’s up a 3-5 percent but I won’t count out a 10 percent either because the divergence could trigger a bigger move should the market head higher in the coming days.

If the technical pattern looks sharp, I do some reading to include filings, press releases and message boards. While the markets looks like they could certainly head lower this week, I’m watching these three small caps just in case.

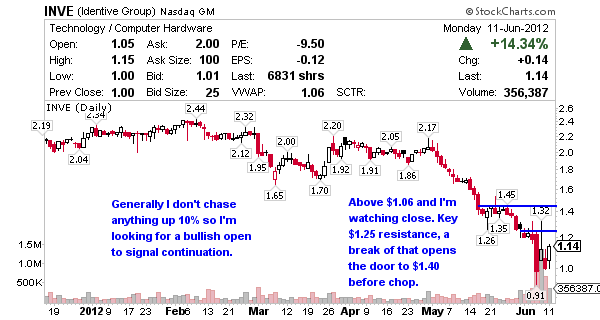

Identive Group (NASDAQ:INVE) provides secure identification (ID) solutions that combine the convenience of radio frequency identification (RFID) with the security of smart card technology to enable people to interact with and manage digital devices, systems, and data. INVE’s stock has a market cap is $68 million with a Beta of 1.4. The short interest is 15 days to cover which definitely had something to do with today’s 14% move. I like this trade above $1.06 and believe a test of $1.30 to $1.50 could be coming soon. Not my favorite chart setup but it’s definitely worth watching.

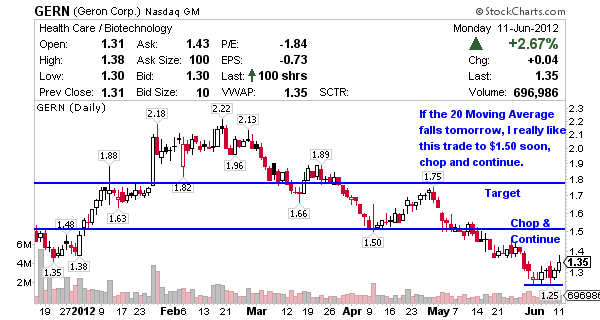

Geron Corp. (NASDAQ:GERN) a biopharmaceutical company, develops therapies for cancer. I’ve worked this trade before, back in late April when it appeared to be making a run at $1.89 resistance but then the market crashed. GERN’s stock has a market cap of $178 million and a Beta of 1.55. The short interest is 13 days to cover and 6% of the float is short. If it holds $1.25 then I’m feeling good about a test of $1.50 to $1.75. Key the 20 Moving Average this week, a break above that should bring in buyers. This is my favorite chart of the group.

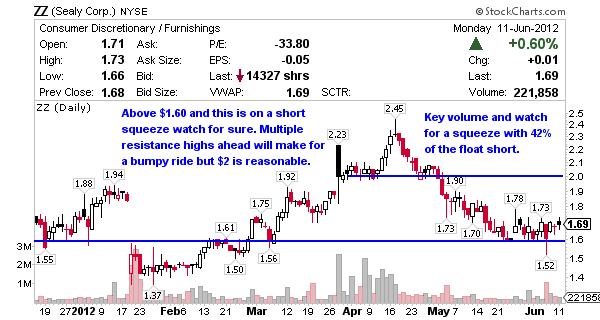

Sealy Corporation (NYSE:ZZ) engages in the manufacture and marketing of bedding products. It offers mattresses and mattress foundations under the Sealy, Sealy Posturepedic, Stearns & Foster, and Bassett brand names in the Americas. ZZ’s stock has a market cap of $170 million and a Beta of 1.57. This has been on my watch for over a week on the curl because I think it’s setting up for a squeeze when you consider the short interest is 46 days to cover and 42% of the float is short i.e. good news and you have a recipe for an explosion. Baring any bad news, key $1.60 as a pattern reversal and continue to cue creeping action because that could lead to a 20% move up around $2 resistance. I like this as much as GERN but it looks like ZZ could be a choppy move should it head higher.

Great looking picks Jason !!! You are the best !!! Keep up the good work !!!!

Zz looks suspicious.The company,if I am not mistaken,is heavily in debt

We’re not playing fundamentals though… our goal it to time price movement.

short selling webinar was bad quaility sound skipping and charts not in time with audio i really hope i can watch this again after improvements. i does seem to be very informative.

Hmmm, seems to load and work just fine here AW and that’s the first time I’ve had any complaints… wonder if it’s your computer? It’s a huge file to upload.

I have watched that video a couple of times and worked just fine for me.

Made good money off CBLI on Monday ran from 1.82 to a high of 2.07 It’s @ 1.94 could make another run up to 2.30?

Yes, I don’t think CBLI is done yet personally.