My clients favorite price range by far is between $1 and $2. AVL, JOEZ, QTM, PSUN and PAL stock round out Friday’s list. Thursday’s watch list had a monster win with BONE up hitting $2 or 27% with no gap meaning you could have easily locked 10% in a day. Remember Jason Bond Picks is about swing trading 5 – 10% rinse and repeat… locking in at least half of the position between 5 – 10% into strength.

I’ve researched these stocks this evening and believe there’s good reason for them to head higher. PSUN is by far the best squeeze setup on this list with 56% of the float short positioned just under a key breakout area. AVL would be the next best at 13 days to cover followed by QTM which definitely drew in some shorts on the reduced guidance. PAL’s not bad at 8 days to cover and JOEZ isn’t really a squeeze play but my wife likes their jeans and I like to squeeze her.

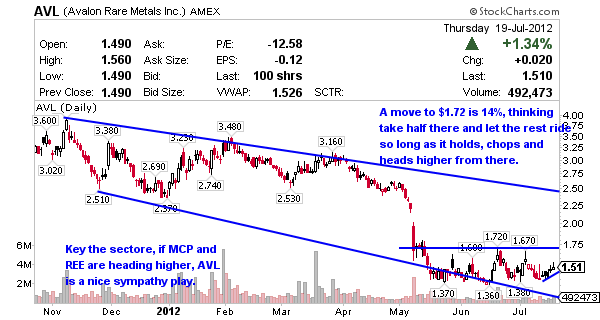

Avalon Rare Metals (AMEX:AVL) engages in the exploration and development of rare metals and minerals in Canada. AVL’s stock market cap is $156 million with a juicy Beta of 3.86 i.e. Jason Bond Picks is the home of highly volatile stocks. The 52 week range is $1.36 – $6.91 and with China playing rare earth hard ball I think AVL is poised to pop here. Short interest is nice too at 13 days to cover with 7% of the float short.

Joe’s Jeans Inc. (NASDAQ:JOEZ) designs, produces, and sells apparel and apparel-related products worldwide. JOEZ stock market cap is small at $77 million which is another way of saying it can fly but the Beta is .75, normally I won’t touch anything under 1 but the swings are good here because their last call beat Wall Street earlier this week. The 52 week range here is $.50 – $1.56 and the short interest is non-existent at 1 day to cover with .62% of the float short. I know the chart looks sloppy from the last call but I’d expect JOEZ to test $1.60 from here, maybe more.

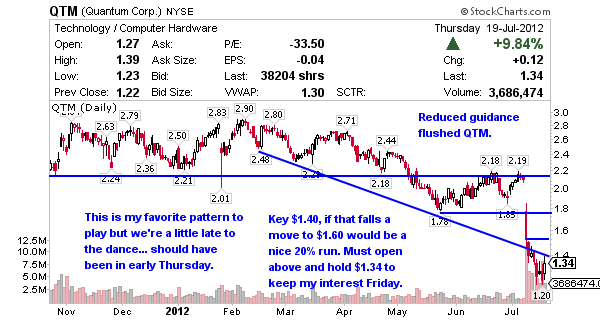

Quantum Corp. (NYSE:QTM) provides backup, recovery, and archive solutions for customers ranging from small businesses to multinational enterprises. QTM is the biggest stock market cap on the list at $317 million and the Beta is an awesome 2.57. With earnings coming up on the 31st of July I’m watching this technical pivot and squeeze to trend higher into next week possibly testing $1.60. The 52 week range here is $1.20 – $3.19 with short interest of 8 days to cover and 4% of the float short. Keep in mind QTM just guided lower so I’m only looking to play the technical pivot and squeeze here.

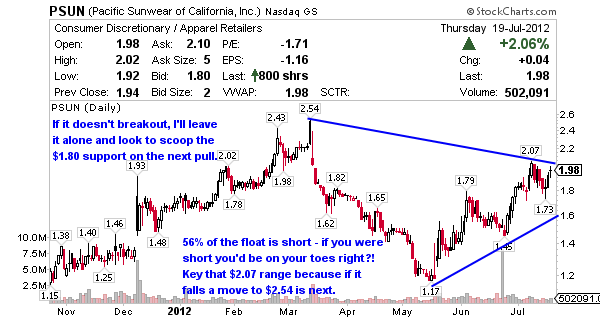

Pacific Sunwear Of California (NASDAQ:PSUN) operates as a specialty retailer in the action sports, fashion, and music influences of the California lifestyle. The only thing ready to squeeze more than a Florida orange is this stock. PSUN’s stock market cap is $134 million and it’s Beta is 1.97. There’s a very good chance I’m a buyer Friday because 56% of the float is short and it’s about to squeeze. The days to cover is 4 and the 52 week range is $1.11 – $3.02. Thursday morning Janney Mntgmy Scott reiterated its rating of Buy for this company and changed its price target from $2 to $3. I’m looking for a move between $2.20 and $2.40 Friday.

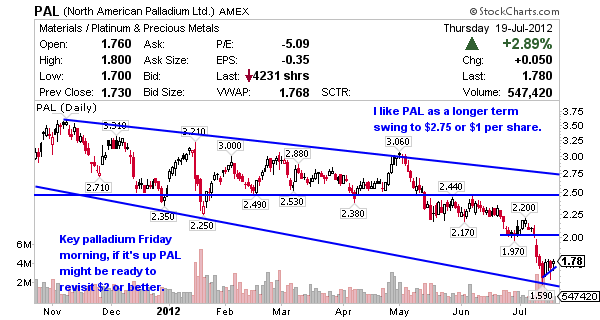

North American Palladium (AMEX:PAL) engages in the exploration, mining, and production of precious metal properties in Canada. PAL’s market cap is $310 million with an awesome Beta of 2.65. The 52 week range here is $1.59 – $4.88 and I really like this chart setup. Key palladium prices in the morning, if they are up and so is the market I think there’s a 5-10% winner here Friday followed by an uptrend to $2.50 – $2.75 or $1 per share from here. The short interest is fairly light here at 8 days to cover with 5% of the float short.

Jb…username posted QTM in chat thursday morning, after clearin a profit on BONE, i jumped in QTM @$1.2695…..would be nice to finish week up!

Thanks for the PSUN alert. +6.7% on the day! Can’t pass up 56% short float on a stock breaking out of its wedge high side. 🙂

Nice trade Wes, glad to hear it.

I jason i bought JOEZ at 1.14 and TAT at 1.01 but it seems like its dropping should I hold and wait are did I get in too soon.

I can’t advise sorry.

Jason, Thanks for the lists on the free blog every once in a while. Still learning, but I like to have a focus list to watch and choose. Up 15% on QTM so far and hope it rides up until the close on Tuesday before Quarterly results announced.

You’re welcome Scott.