With gold and silver prices staging huge rebounds from the lows of $1,200 and $18, respectively, the gold price has just made the all-important Golden Cross – to the upside! Millions of traders across the globe just received the ‘all aboard’ signal to the bull market train in the precious metals (PM) market.

“ . . . this imminent upside explosion is simply a mathematical phenomenon for those of us who took algebra II, which was a requirement for me to enter Cal Berkeley in 1955 (I will be 77 years old this September),” an anonymous veteran trader and repeat guest told King World News. “This imminent “Golden Cross” signals good times ahead for those patient investors positioned in gold, silver, and the shares.”

And as an addendum to the latest Golden Cross signal, we should warn investors that there had been false signals in the past. This Golden Cross signal we’ve anticipated in June, however, was triggered concurrently with two other closely-watched indicators by the big Greenwich, CT money managers.

Those two technical indicators are the monthly Slow STO and monthly MACD. Both of these indicators have also crossed to the upside, which, together with the Golden Cross signal, give us a more than 90% confirmation of a sustained bull rally in PMs and PM stocks ahead.

“Currently there is a large commercial short interest in silver, and an abundant number of buy stops just above $1,330 in gold,” Anonymous said. “When these are activated, there should be an explosive reaction which is confirmed by the MACD at the top of the chart crossing zero.”

We like the odds here in the PM market, and don’t get this kind of setup often, especially in such an explosive marketplace as the PM stocks. So, all of that technical ‘green lights’ therefore begs the big question:

Which stocks offer the best bang for the buck during the expected whale of a rally in gold and silver prices?

After four years of observing the peculiarities of the PM sector, and the price reaction to events in the shares market, three (3) stocks consistently outperform their brethren as prices of the metals sustain a continual rise.

The 3 Biggest Movers in the PM Sector

Price: Under $10

Market Cap: $1.27B

Price to Book: 1.32

Revenue: $202.27M

Qtrly. Rev. Growth: 4.2%

Operating Margin: 18.97%

Cash $87.3M

Summary:

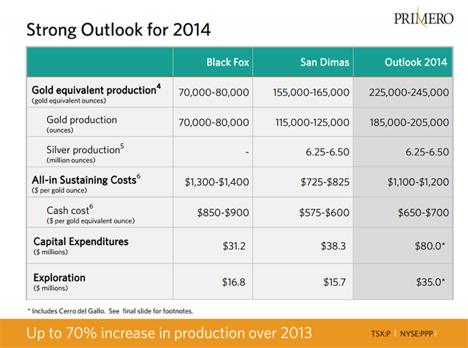

We anticipate Primero to surprise investors with higher-the-expected output at the San Dimas mine.

With the acquisition of Brigus’ Black Fox mine, Primero is poised to become a mid-tier producer of gold and silver.

Output for fiscal year 2014 could reach more than 210,000 ounces of gold, and more than 6.5 million ounces of silver. If the company can beat production goals, PPP could regularly appear on the ‘Big Movers’ list, attracting additional momentum traders to the stock.

Source: Primero Mining Investor Presentation Materials

Price: Under $10

Market Cap: $843.9M

Price to Book: 1.09

Revenue: $43.61M

Qtrly. Rev. Growth: -17.5%

Operating Margin: -202.47%

Cash $19.47M

Summary:

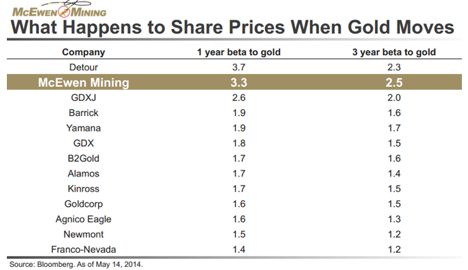

We believe MUX is a superior junior mining company, with high-quality management, record of increased production and replaced reserves, and properties located in politically-safe jurisdictions.

McEwen Mining has no debt, of which will come into play when the industry begins consolidation. We expect further acquisitions from McEwen in the future.

Additionally, management has consistently been accurate with production forecasts and development goals at its El Gallo 1 and El Gallo 2 production sites.

Source: McEwen Mining Investor Presentation Materials

Price: Under $10

Market Cap: $772.71M

Price to Book: 1.85

Revenue: $59.77M

Qtrly. Rev. Growth: -0.4%

Operating Margin: -80.48

Cash $110.96M

Summary:

Sandstorm is a small-cap ‘streamer’ (not a miner) of precious metals mining operations, with more than $110 million of cash on its balance sheet, no debt, and a credit line of $100 million.

The advantage of a streamer is the lower and higher margins, allowing the company to leverage its capital with limited downside risk. New deals for Sandstorm come a little easier during periods of tight capital and lulls in the mining sector, which is the only meaningful drawback to rapid growth and superior margins for the company.

Sandstorm holds a portfolio of 37 gold streams and royalties, with 14 of these deals providing good cash flow. The remaining deals are in the development and/or exploration stage.

Final Thoughts

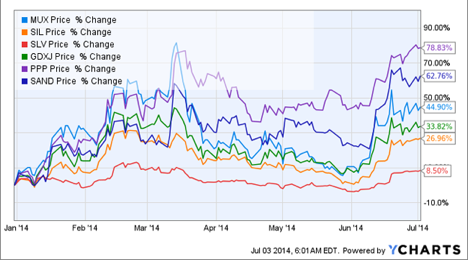

Unless there are material changes at a company that warrant a rethink, past share performance during rallies in the precious metals offer a clue to the future share performance. We believe Primero Mining (PPP), McEwen Mining (MUX) and Sandstorm Gold (SAND) offer a better risk/reward profile than the Exchange Traded Funds (ETFs), GDXJ or SIL.

Investors seeking higher risk to the more-diversified ETFs, we strongly suggest performing your own due diligence on the three focus stock of this Special Alert.

And finally, as an additional call to investors of the urgency we see in the precious metals markets, we leave you with a quote from revered economist, John Williams, of ShadowStats.com, who recently stated:

With the federal government and Federal Reserve locked in their respective system of destructive fiscal and monetary policies, a related, continuing massive loss of global and domestic confidence in the US dollar, should lead to an outright dumping of the US currency in the global markets, setting the initial stages of a hyperinflationary great depression. The timing of the hyperinflation onset by the end of 2014 remains in place, with the odds of that occurrence estimated at 90%.

Looking for another big stock idea?

To get a heads-up on other stocks we feel will better your rate of profit, start by joining our mailing list (top of the page). Or, take the next step now by joining Jason’s community of dynamic and active traders with a subscription to Jason Bond Picks.

Click here for 2013 Performance Record +77%.

Hi, I have a question on Golden crossover. In the above MUX chart, Golden crossover occured but stock fell and made Death crossover but it didnt proceed with Death crossover too further. Rather it again made golden cross over.

My query is how to find out the legitimate golden crossover and how to recognise false cross overs and when to enter based on these cross overs. Could you please throw some light on it. Thanks

The best way it to monitor the trade for momentum as you’re trading it. All a crossover tracks are moving averages and when a short term moving average crosses a long term you would think momentum favors the bulls. So confirmation is only done by day to day assessment of the momentum.

Could you please share the information with some examples since I could not picturise your views. And please also let me know when to enter and when to exit based on these golden cross overs. Thanks

I don’t use crossovers for entry. If it’s there though it’s supporting evidence.