Mobile app developer Glu Mobile (GLUU) has soared a hefty 61.7% from our alert of May 15 (and reiterated reminder on June 30), and up 11.7% Friday following comments made by research firm Cowen & Company and its eye-popping revenue projection from Glu’s latest hit, Kim Kardashian: Hollywood!.

“Hollywood may reach $200 million [annually], estimates Douglas Creutz, an analyst with Cowen & Co. in New York, who has the equivalent of a buy rating on Glu Mobile and expects the stock to rise to $6 in the next year,” according to Bloomberg News.

“Some are huge hits for three or six months, some for a year, but they all have a long tail for meaningful monetization,” said Creutz. “Even if it tails off by 50 percent, this game is still a huge needle mover for this company.” [emphasis added]

“Some are huge hits for three or six months, some for a year, but they all have a long tail for meaningful monetization,” said Creutz. “Even if it tails off by 50 percent, this game is still a huge needle mover for this company.” [emphasis added]

Kim Kardashian, the reality-TV star whose commercial empire which includes a line of clothing, jewelry and cosmetics, now adds game apps to her growing enterprises.

Since its June 25 release, Kim Kardashian: Hollywood had reached as high as the no. 2 download among the ‘free-to-play’ games category at the Apple App Store.

Glu Mobile CEO Niccolo de Masi said Kim Kardashian: Hollywood “might be our biggest game of the year.” He added, “We’re not surprised. Kim is a one-of-a-kind talent with an incredibly precise fit to the game engine that we tailored but already had in the company.”

So far, Glu’s strategy of partnering with public figures and current events has paid off handsomely. The mean estimate of eight analysts polled by Bloomberg is for Glu to reach revenue of $160.5MM for fiscal 2014, a more than doubling (29.5% CAGR) the $74MM of top line posted for 2011.

With the addition of Kim Kardashian: Hollywood! and the additional $200MM potential sales that come from the latest hit, Glu’s recent history of marginal profitability may be a thing of the past.

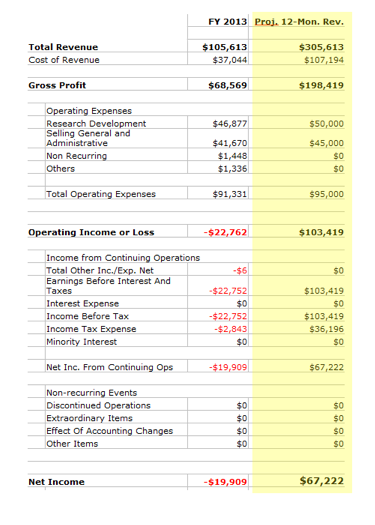

If Cowan is Correct, What Will Glu’s P&L Look Like?

Running a new projected revenue potential from the addition of Kim Kardashian: Hollywood!, the bottom line shows that the new hit could truly be a “huge needle mover” as Cowan & Company’s Creutz has suggested.

Exhibit 1.0

Evaluating Glu’s past income statements indicates that calculations to reach a projected bottom line isn’t that difficult. No complex debt structure, inventories and extraordinary items need to be estimated to draw a conclusion about the company’s bottom line.

Essentially, if Cowan & Company is anywhere near to an accurate prognostication with respect to the revenue potential of Kim Kardashian: Hollywood!, Glu’s profit is poised to utterly soar; it’s what investors have been waiting for: An additional significant moneymaker to, not only broaden Glu’s ‘pen’ of winners, but cover its R&D and SG&A overhead, too.

Jason Bond’s ‘Take’ on GLUU’s Valuation

Hint: Much Higher Than Today’s Stock Price of $6

What would you pay for $67MM of net profit? And as a corollary, what would you pay for a potential earnings growth rate of 42.5% ($305MM to $74MM within 4 years)?

Firstly, Jason points out to his 100,000+ followers that the S&P now trades at:

Price-to-Earnings: 19.51

Price-to-Book: 2.75

Price-to-Sales: 1.76

Contrastingly, GLUU trades at:

Price-to-Earnings: N/A

Price-to-Book: 7.83

Price-to-Sales: 3.48

On the surface, GLUU appears to be trading at a rich valuation, and it is! And the JBP article of June 30 mentions just that.

However, given the news of the potential revenue stream of Kim Kardashian: Hollywood! to Glu’s top line, we agree with Cowan, in that Kim Kardashian: Hollywood! could be a “huge needle mover” for the company and investors of GLUU.

Setting aside the metric “Price-to-Book” – because the company’s business model doesn’t match very well with a broader index of 500 stocks which make up the Standard & Poor’s 500 index – we then focusing upon the relative valuation of Glu’s projected revenue of $305MM to GLUU’s closing price of $6 Friday. Here’s where the valuation picture becomes more clear.

Taking the $305MM revenue estimate, and recalculating Price-to-Sale and Price-to-Earnings (see Exhibit 1.0, above), we get a Price-to-Sales and Price-to-Earnings ratio for GLUU of 1.60 times and 7.25 times (82.7 cents per share), respectively.

Frankly, with Glu’s revenue growth rate approaching 50%, and a P/E ratio estimated to reach as low as 7.25, a $6 stock price relative to the S&P500 could be considered quite CHEAP. While investors reach for the sky with the S&P500 index and its 15.82% earnings growth rate and 19.51 P/E ratio, GLUU’s prospects for, not only outperforming the S&P, but downright slam dunking the S&P on a risk/reward basis are compelling – to say the least.

In fact, if investors begin to see the kind of revenue Cowan & Company expects from Kim Kardashian: Hollywood! posting to Glu’s top line in coming quarters, Jason expects investors could bid GLUU to at least a P/E ratio level of the S&P500’s 19.51 – which calculates to a $16.12 per GLUU share. That’s more than a four-bagger from Jason’s original Alert of May 15 (after the NYSE close), at which time GLUU closed at $3.71 on the following day.

How likely will Cowan’s revenue projection for Kim Kardashian: Hollywood! come to pass?

“It [Kim Kardashian: Hollywood!] is the only title among the top 10 in the App Store with a five-star rating, the highest possible, based on thousands of user reviews,” according to Bloomberg. [emphasis added]

Looking for another big-idea stock like GLUU?

To get a heads-up on other stocks we feel will better your rate of profit, start by joining our mailing list (top of the page). Or, take the next step now by joining Jason’s community of dynamic and active traders with a subscription to Jason Bond Picks.

Click here for 2013 Performance Record +77%.

0 Comments