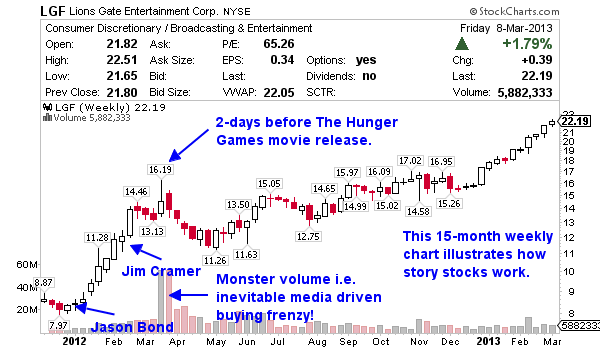

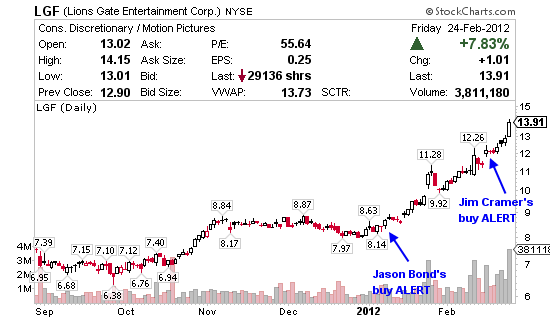

On January 9, 2012 I bought 2,000 shares of Lions Gate Entertainment Corp. (NYSE:LGF) stock at $8.47 and alerted subscribers because I was convinced “The Hunger Games” release in March would drive the stock price significantly higher. The following day I added 2,000 shares to my position at $8.85.

Over a month later, on February 14, 2012 CNBC’s Jim Cramer did a detailed segment on Mad Money basically saying everything I told my subscribers well over a month earlier at $8.47 before the massive run. That’s right, the morning Jim Cramer’s viewers had a chance at the LGF stock it opened at $12. And while Jim Cramer’s viewers are doing okay since his segment, with the stock price climbing from $12.00 to 14.24 or 19%, I can’t help but feel AWESOME knowing I beat CNBC’s elite stock picker by 49%. That’s right, my subscribers have seen and had a chance at a massive 68% gain since my $8.47 alert compared to Jim Cramer’s 19% at $12 and both alerts were alerted for the same reasons.

While I don’t pretend to have nearly the same level of experience as Jim Cramer and fully respect this man’s career, Wall Street is about results and this is proof little guys like myself can deliver big wins. Keep in mind, I do all my research myself and don’t even have a massive research team like Jim Cramer does.

Kinda makes you scratch your head right?! I mean how did Jim Cramer’s team fail to spot this HUGE catalyst back in January when I did if not sooner? As a matter of fact, I can only wonder if they subscribe to my service and possibly took the story from me? Of course they’ll never admit it or even comment on my questions here but that doesn’t stop me from being curious. If they did happen to read this, I’m sure they’d just laugh at guys like me, a lot like Nike probably laughed at Under Armour early on before Under Armour grabbed a huge portion of the market share on explosive growth. Makes you wonder if my newsletter will compete with Jim Cramer’s products at some point, of course you know what I think ha!

Anyway, since you might be skeptical I bought and alerted LGF well over a month and 49% cheaper than CNBC’s Mad Money Jim Cramer himself, here are some detailed notes I wrote to my subscribers as this swing trade progressed.

- 1/9/12 – Bought 2,000 LGF at $8.47 on high of day break here. This one is from the watch list and I plan to add 2,000 shares higher or lower.

- 1/10/12 – Added 2,000 LGF at $8.85. Now long 4,000 LGF at $8.66

- 1/11/12 – My goal is a breakout above $9 which should shoot it up into the $10 – $11 range. I feel confident LGF will breakout.

- 1/13/12 – I’m planning on holding LGF long and I mean long…probably a month or two. LGF has a lot and I mean a lot going for it right now and I think it trades well above $10 soon.

- 1/20/12 – I probably won’t look to sell until we get closer to “The Hunger Games” release date of March 23, 2012. There are plenty of good catalysts here to make this a $12 stock or better. I plan to double up at some point.

This taken from Mad Money on 2/14/12.

The highly anticipated “The Hunger Games” movie will be a giant needle mover for Lions Gate Entertainment, “Mad Money” host Jim Cramer said Monday.

Poised to hit theaters in March, “The Hunger Games” is based on the first book in the best-selling trilogy by Suzanne Collins.

“You need to get in this stock ahead of the March release date,” Cramer said, “even as Lions Gate has already run up massively since the beginning of the year, rallying 35 percent all on the buzz for ‘The Hunger Games.'”

While the wildly successful Harry Potter films were barely enough to move the needle at Time Warner, Cramer thinks “The Hunger Games” will be different for Lions Gate. That’s because Loins Gate is a small, independent production company with a market cap of $1.5 billion, so it will take a lot less to move the needle.

The release of “The Hunger Games”—expected to be a blockbuster—will give the movie division a huge boost, he said. The film already has a huge fan base and built-in sequel potential thanks to the trilogy—the first book alone sold more than 16 million copies.

“Let’s assume the movie grosses $200 million at the domestic box office … That would mean about $125 million in profits for Lions Gate,” Cramer said. “If each successive sequel generates 10 percent more profits … then the entire franchise could end up being worth $400 million to the company.”

He thinks Loins Gate is cheap at these levels, and would buy it whenever it dips between now and the release of “The Hunger Games.”

Here’s proof my subscribers locked in HUGE gains on my alert of Lions Gate Entertainment Corp. (NYSE:LGF) stock at $8.47.

Subscriber name: Casey

- Verified trade: http://profit.ly/1Mml5a?aff=304

- Profit: 11% or $5,250 profit

- Comment: Sold my LGF @ $10.60 for over $5k profit! Thanks Jason! Wanted to hold longer but need the cash.

Subscriber name: TheWogShow

- Verified trade: http://profit.ly/1MmnD0?aff=304

- Profit: 41% profit or $1,392

- Comment: This was an excellent long swing from Jason’s alerts. I wish I had bought a larger amount, but this was my first trade with Jason. He originally said he’d consider holding for 2 months, I held just over 1 month and simply had to close out 41% and $1,400 in profits.

Or how about subscriber Briantrades101 who took a long option and as of January 25 he said, “Biggest trade of the year so far. Up 400% and still open. Thanks Jason Bond.”

As a real swing trader and teacher of swing trading, I’m always on the hunt for the next big story and unlike most, put my money where my mouth is. I wrote this piece because I want people to know that while my marketing budget is nothing compared to CNBC’s Jim Cramer, that doesn’t mean you get better results with the major premium newsletters Wall Street has to offer. Like the Food Network’s Diners, Drive-ins and Dives with host Guy Fieri, sometimes the little guy simply makes a better burger because their livelihood is on the line. See major media is just looking to capitalize on the story because it’s popular now, where as I look to capitalize on the trade by getting in before it becomes a big story.

When I first started trading last year, Cramer recommended Alcoa as a hot buy, so I bought in and it immediately dived. It still hasn’t recovered, as I bought in at around $11.50. I will never follow Cramers Advice again, but would like to try out your service. Question. When did you close your LGF? Do you have a clear exit strategy? Thanks.

Hi Mano. I closed it out early fearing the market would pull and I could buy it up cheap again after locking in a big profit. I only made about $4,000 on that trade on the way up, had I held until March like I suggested I’d have locked about $20,000 plus. My exit is normally 5-10% profit on all trades regardless of where I think it could go.

good trade. LGF traded that movie release like a biotech: buy on rumor, sell on news! sometimes these catalysts are so obvious, it makes one wonder, ‘hey, why didn’t I think of that’?!