On Tuesday, shares of Plug Power (NASDAQ: PLUG), which focuses on the design, development, commercialization and manufacture of fuel cell systems for the industrial forklift market, surged after some bullish predictions from an analyst.

Plug Power shares rose 16% on Tuesday, and are now up nearly 200% for the year. The significant gains certainly suggest that investors are equally bullish on Plug Power’s prospects. Indeed, while the company has seen a broad customer acceptance of its GenKey, the analyst’s predictions are unlikely to be met.

Analyst paints a rosy picture

On Tuesday, Plug Power shares surged more than 16% after Aditya Satghare, analyst at FBR Capital Markets, began coverage on the stock with an Outperform rating, citing multiple catalysts for growth. The rally in Plug Power shares also boosted other fuel cell stocks such as FuelCell Energy (NASDAQ: FCEL) and Ballard Power Systems (NASDAQ: BLDP).

Satghare said that Plug Power is currently in its early stages of growth; however, catalysts include new orders in the U.S., a possible expansion in Europe, and the rollout of hydrogen deliveries. The analyst further added that risk/reward profile of Plug Power is attractive at current levels, and set a price target of $8 on the stock.

More importantly, Satghare came out with some bold predictions. He said that demand for electric forklifts is increasing and Plug’s annual revenue from fuel cells to power them may cross $200 million by 2017. He added that the company may supply components for 10% of the U.S. market by 2017 to customers that include Wal-Mart Stores (NYSE: WMT).

The bullish prediction not surprisingly boosted Plug Power shares, which had already posted significant gains for the year prior to Tuesday’s rally.

Plug Power continues to surge

After Tuesday’s 16% gain, Plug Power shares are up nearly 200% for the year. This was after the stock gained more than 180% in 2013.

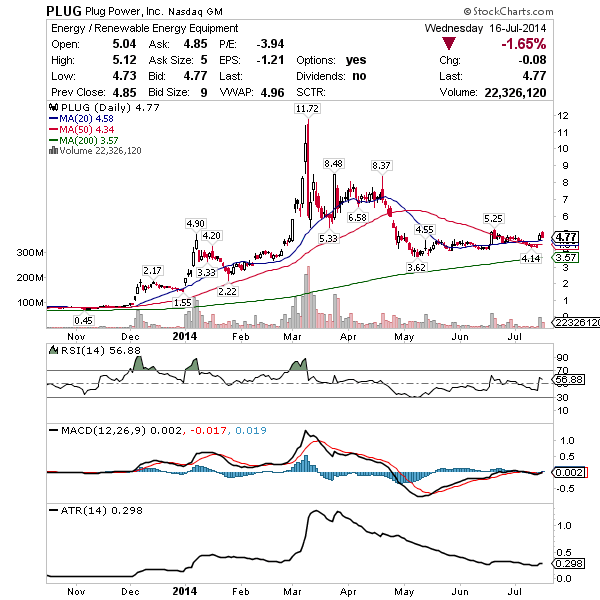

Source; stockcharts.com

The chart above shows that Plug Power shares surged in the first quarter, but saw a pullback at the start of the second quarter. The stock had been trading sideways before the rally on Tuesday. Tuesday’s rally allowed Plug Power shares to cross above their 50-day moving average. The stock also briefly broke through $5 resistance level before slipping. The stock has struggled to break through this key resistance level since May.

Plug Power has outperformed its peers FuelCell and Ballard Power, although the performance these two stocks have also been phenomenal.

Indeed, fuel cell stocks have been surging as commercial sales of fuel cell systems is expected to be strong. Plug Power itself has seen broad acceptance of its technology. As Satghare noted in his research report on Tuesday, the company has a diverse customer base, which will continue to transition to hydrogen-based forklift fleet solutions. However, it will be interesting to see if the company can achieve the revenue predicted by FBR Capital Markets.

Challenge for Plug Power

FBR’s revenue prediction could be too bullish. While Plug Power has been seeing more orders, there is still some way to go before it reaches the $200 million revenue mark. It must be noted that fuel cell technology has been around for a while now. Still, Plug Power’s revenue in 2013 was just $26.6 million, compared to total revenue of $26.1 million in 2012. In the first quarter of 2014, Plug Power registered revenue of $5.6 million, down from $6.4 million reported for the same period in the previous year. These numbers certainly suggest that the analyst’s predictions are probably too bullish even though the company has signed some major deals with the likes of FedEx (NYSE: FDX) and Wal-Mart Stores since late last year.

0 Comments