Double your pleasure, double your fun! Nothing is better than a $1 small cap double up run. TAT, BONE, FCEL, VTG, CWTR, PLUG and USAT stock are Thursday’s account builders. Tonight’s scan was for continuation patterns from video lesson 2 between $.50 and $2 with market caps ranging from $50 million to $2 billion. My price filter was $.50 to $2 and I weeded out illiquid stocks. I think there are some solid winners here but before you get all hot and bothered about getting rich, please understand it’s a watch list and I weigh a number of other factors before making my purchase (Entry is key, learn what I look for).

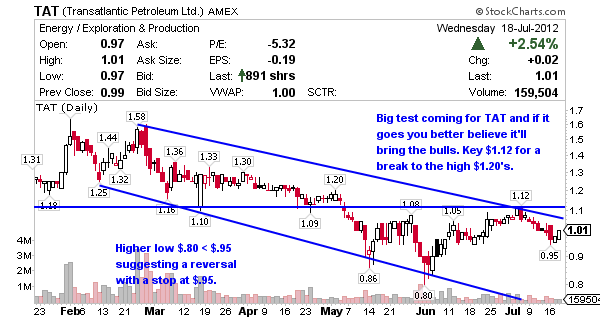

Transatlantic Petroleum Ltd (AMEX:TAT) is an international oil and natural gas company, engages in the acquisition, exploration, development, and production of oil and natural gas properties. TAT’s stock market cap is fairly large for an account builder at $370 million but it has a too hot to handle Beta of 1.95 meaning don’t catch this one in a downtrend. Anyway, I’ve scored big on TAT stock before and it’s 52 week range $.57 – $1.71 with a pending top channel break at $1.05 has my interest. The short interest is 8 days to cover with 1% of the float short.

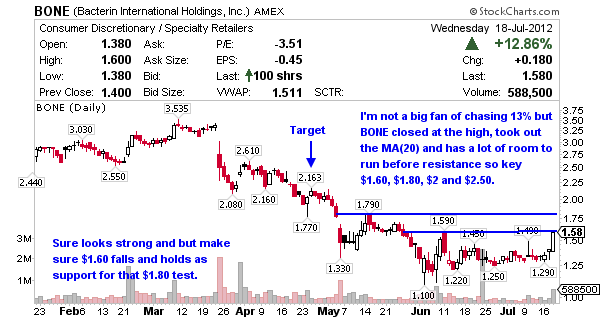

Bacterin Intl Hldgs (AMEX:BONE) develops, manufactures, and markets biologics products in the United States and internationally. While the market cap is small on BONE stock at $67 million, the Beta of 1.17 suggests it’s not as volatile as I’d like, however the current price action sure looks like a run is brewing. Despite the low Beta, the 52 week range of $1.10 – $3.93 is juicy which is why I’d be watching for this one to head higher. Not much short interest though at 3 days to cover with 4% of the float short.

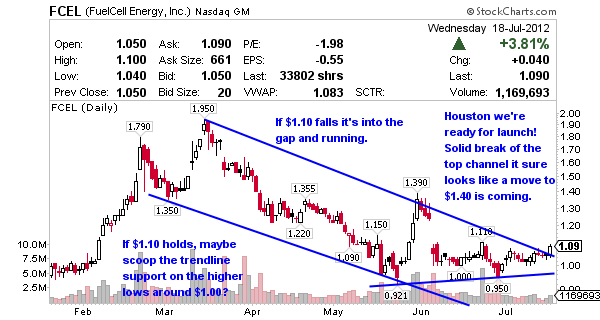

Fuelcell Energy (NASDAQ:FCEL) engages in the development, production, and sale of high temperature fuel cells for clean electric power generation. FCEL’s market cap is $203 million which is right in my wheelhouse, especially give the sexy Beta of 2.76 – they don’t call Jason Bond Picks your #1 stop for highly volatile stocks for nothing!!! Currently the price is at the low end of the 52 week range of $.80 – $1.95 and the price is making a bullish channel break. The short interest is 5 days to cover with 7% of the float short this one.

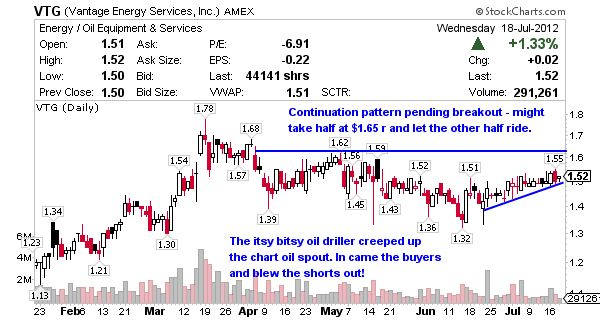

Vantage Drilling Company (AMEX:VTG) provides offshore contract drilling services to oil and natural gas companies in the United States and internationally. VTG’s stock market cap is $444 million so it’s by far the biggest on this list. With a cap that size and a Beta of 1.33 don’t expect this one to move as fast as the others should it catch a bid. The 52 week range is $.97 – $1.78 illustrating the tighter range. VTG’s short interest is 14 days to cover with 7% of the float short.

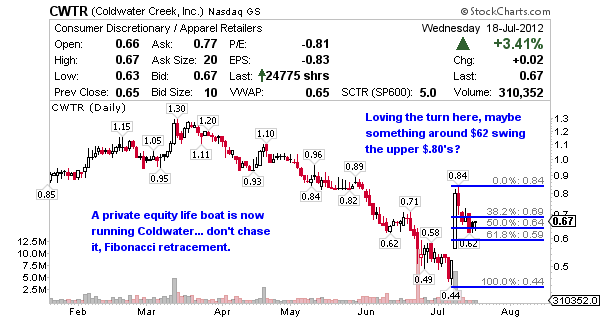

Coldwater Creek (NASDAQ:CWTR) operates as a multi-channel specialty retailer of women’s apparel, accessories, jewelry, and gift items primarily in the United States. CWTR’s stock market cap is $82 million with a Beta of 1.22 and a 52 week range of $.45 – $1.83. The short interest is only 3 days to cover with 7% of the float short. Last Tuesday private equity firm Golden Gate Capital tossed out a lifeline to the struggling company and now that it’s retraced the move I’m thinking it heads higher from here.

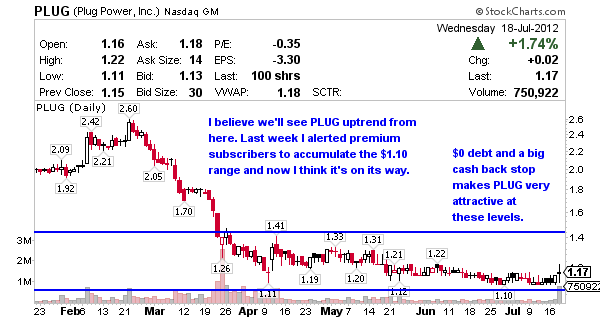

Plug Power (NASDAQ:PLUG) is an alternative energy technology provider, engages in the design, development, commercialization, and manufacture of fuel cell systems for the industrial off-road markets worldwide. Currently a nano, PLUG’s stock market cap of $44 million is tiny but it’s not that volatile with a of Beta 1.56. The 52 week range $1.10 – $2.71 makes it attractive, especially if they keep selling fuel-cell systems to Mercedes-Benz. The short interest is up there based on the light volume at 23 days to cover with 9% of the float short. Book value is $1.03 and these guys have $0 debt with a $21 million cash backstop.

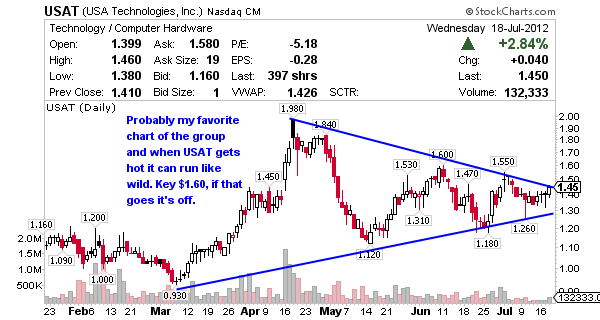

USA Technologies (NASDAQ:USAT) supplies cashless, remote management, reporting, and energy management solutions for the unattended point of sale market primarily in the United States. With a stock market cap of $47 million and a Beta of 3.07 this nano cap can fly. The 52 week range is $.93 – $2.47 and the short interest is 8 days to cover with 6% of the float short.

What is a premium subscriber as opposed to my subscription???

Premium refers to those who pay versus the free customers, you are a premium subscriber Michelle and for that I thank you 8)

I know the education is really taking hold….first time I was able to really see the patterns you teach and understand each of these stocks so that if any are alerted I will have confidence in my trade…thanks

Excellent, glad to hear it Blair and thanks for saying so.

Hello Mr bond

I was just wondering if there was a way to contact you.I an extremely interested in joining but have a few questions that I am not comfortable. Posting on a open form

Thank you jeff wallace

Sure Jeff that’s understandable. Appreciate you calling me Mr. Bond too but Jason works for me 8)

My email is jason@jasonbondpicks.com – I’m off to bed here soon but get to all emails daily so I’ll be in touch tomorrow.

How can I put money into a stock for investment ?

Open an E*Trade account.

gold and silver will go high price to purchase or down give me the price

Dear Jason,

I’m a retired Vet trying to make ends meat with just a little money to play with and need your expert opinion on doubling my money for two weddings coming my way next year, any advice or strategies is much appreciated. I have a friend of mine, another vet working your system and doing well, he advised me to contact you. Have A Great Day!

Hi Mike, I can’t give feedback like that… the promise of returns is something I’m not allowed to do. I can’t advise either, both of these are strict SEC rules. I believe there’s a lot of value in my service at $297 / quarter, hope you join us.